For Gen Z Professionals Tired of Outdated Money Advice From People Who Bought Houses for $60K

New Book Reveals: How to Master your Money Or Stay Broke Forever - Your Choice

Get clear direction on building wealth in today's economy, practical strategies that acknowledge your reality, and financial confidence using the only money guide designed specifically for the challenges your generation faces

The Gen Z Money Guide

2 Hours to Financial Confidence

What Is “Earn, Save, Spend”: The Gen Z Money Guide?

It's a beautifully illustrated financial guide that acknowledges the economic reality young professionals face today and...

It's designed for YOUR generation's economic challenges, not your parents'

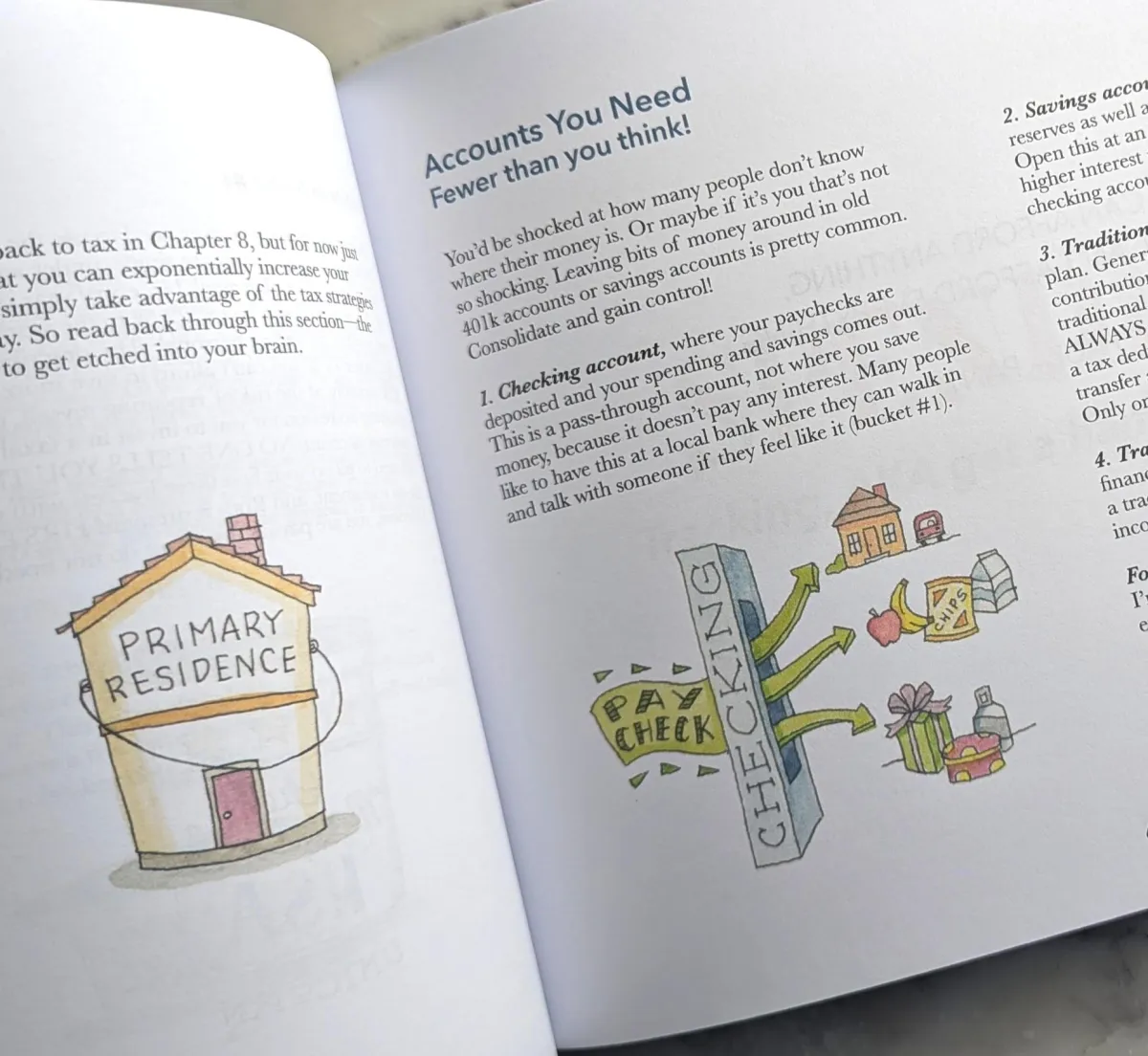

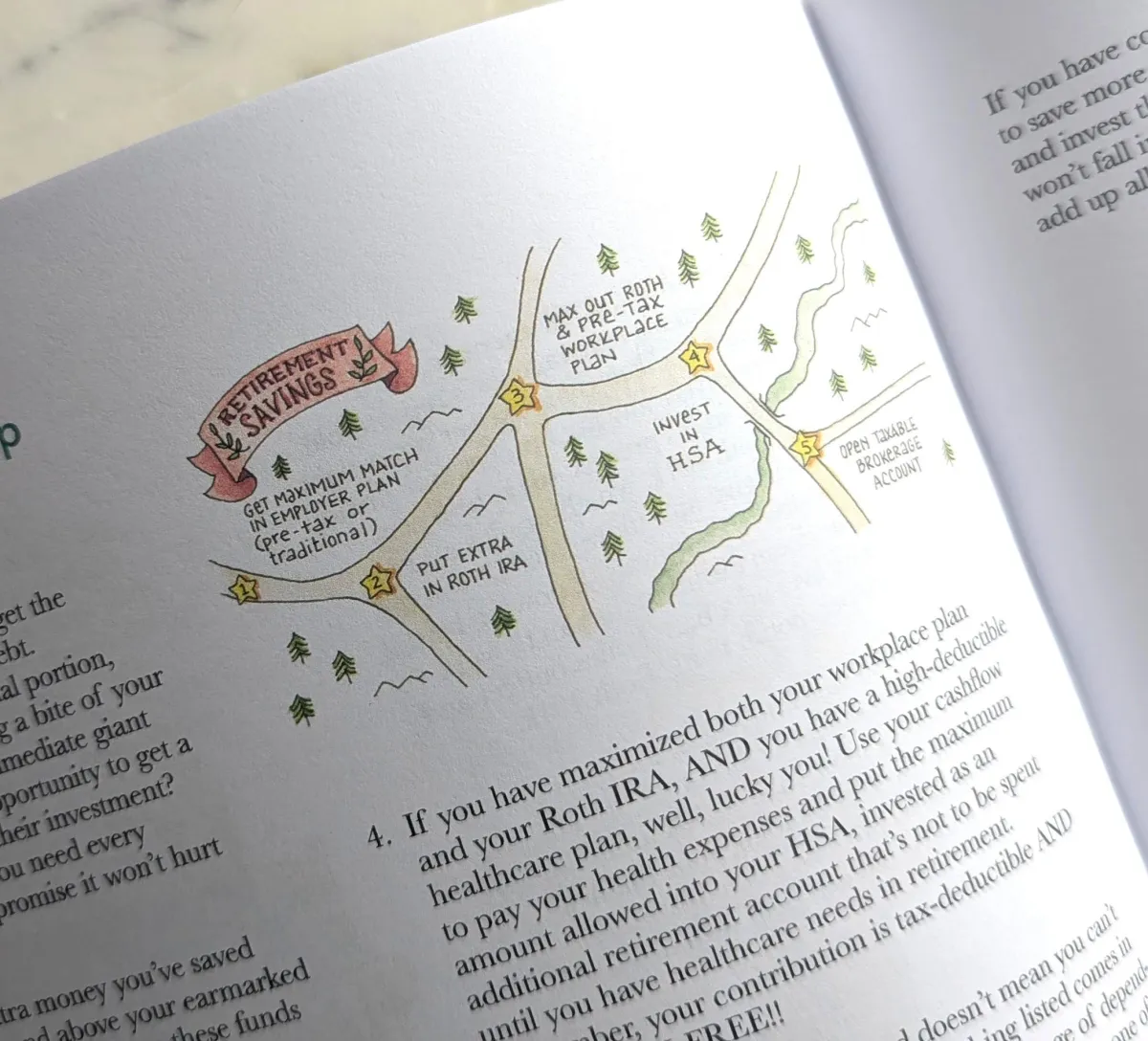

✔ Uses engaging illustrations to make complex concepts crystal clear

✔ Provides practical strategies that work with today's wages and costs

✔ Addresses the real barriers young professionals face (not outdated advice)

It's not generic advice from someone who bought a house for $60,000...

It's not "stop buying avocado toast" lectures...

It's real financial guidance for the economic system you're actually navigating — illustrated in a way that’s non-judgmental. (And it REALLY works)

Who This Is For:

✔ Young professionals earning $75,000+ who feel behind despite doing "everything right"

✔ College graduates drowning in conflicting financial advice from different generations

✔ High-achievers who are tired of being blamed for economic problems they didn't create

✔ Anyone who wants financial guidance that actually understands today's economic reality

NOW AVAILABLE FOR INSTANT DIGITAL DOWNLOAD

ONLY A FEW DAYS LEFT DURING PROMOTIONAL LAUNCH PRICING

Special Price $5.00

100% secure 256-bit encrypted checkout

Here's How This Works:

You'll follow Laura's illustrated journey to easily...

1. Master the fundamentals of personal finance using clear, visual explanations that make complex concepts stick.

2. Understand how today's economy is different from what your parents navigated and why their advice often doesn't work.

3. Build confidence in your financial decisions by understanding the "why" behind money management, not just the "what."

4. Create a foundation for wealth building that works with your actual income and today's cost of living.

✔ No financial background needed

✔ No boring textbook-style learning

✔ Just beautiful illustrations and practical wisdom that actually applies to your life

Why I Wrote The Gen-Z Money Guide

My name is Laura Davis. For over 10 years I've been a financial advisor, and for the past 2 years I've run my own registered investment advisory working with high net worth clients.

But I noticed something troubling...

The young professionals I spoke with were getting terrible, outdated advice that didn't match their economic reality.

They were being told to "work harder" and "stop spending on luxuries" by people who:

✔ Bought houses when they cost 3x annual income (not 8-10x like today)

✔ Entered job markets with real wage growth

✔ Didn't face $50,000+ in student debt as a starting point

✔ Weren't bombarded with sophisticated marketing designed to separate them from their money

I realized young professionals needed financial guidance that acknowledged their reality, not lectured them about a system that no longer exists.

So I created this illustrated guide specifically for your generation.

Using anthropomorphic animal characters and visual storytelling, I made complex financial concepts accessible and engaging — without the condescending tone or outdated assumptions.

And it worked!

Young professionals finally had financial education that spoke to their actual situation and gave them tools that work in today's economy.

Now you can get that same foundation too.

Why It Just Might Work (When Nothing Else Has)

Because this isn't another book telling you to live like your grandparents did.

This acknowledges the economic system you're actually operating in — where wages haven't kept pace with costs, where "entry-level" jobs require years of experience, and where you're competing against sophisticated marketing designed to separate you from your money.

When you finally get financial advice that understands your reality... everything changes.

What This Means For You…

No More:

✔ Getting lectured about avocado toast while struggling with real economic challenges

✔ Following advice from people who bought houses for the price of today's cars

✔ Feeling guilty about financial struggles that stem from systemic issues

✔ Wondering if you're "doing money wrong" when you're playing by different rules

Instead You'll Get:

✔ Clear financial strategies designed for today's economic reality

✔ Illustrated lessons that make complex concepts actually make sense

✔ Confidence in your money decisions based on understanding, not fear

✔ A foundation for building wealth that works with your actual income and costs

The Illustrated Financial Guide That Finally Acknowledges Your Generation's Economic Reality — Even If You're "Not Good With Money"

This guide is built on everything I've learned from a decade working with high net worth clients and understanding the real challenges young professionals face. I've distilled years of financial advisory experience into one beautifully illustrated system, so you don't have to navigate conflicting advice alone.

Why It's Just $5.00 (For Now)

Until now, this type of financial guidance designed specifically for young professionals has only been available through expensive financial advisors or generic courses that don't address your generation's unique challenges.

But after seeing how powerful this illustrated approach is for helping young professionals gain financial confidence, I decided to make it accessible to everyone who needs it.

Let's Get Started!!!

It takes about 2 hours to read through completely.

It becomes your foundation for all future financial decisions.

This is the clarity you've been looking for — practical, beautifully illustrated, and built entirely around the economic reality you're actually facing.

This isn't just another financial book. The moment you see how the illustrations make complex concepts simple, and how the advice actually acknowledges your challenges, you'll understand why this approach works when traditional financial education doesn't.

Here's What Young Professionals Have Said About "Earn, Save, Spend"

"Finally, a financial guide that doesn't make me feel stupid for struggling in today's economy. The illustrations made everything click in a way textbooks never could."

— Sarah M., Marketing Professional

"This is the first financial book that acknowledged my student loans and today's housing costs as real factors, not personal failures. Life-changing perspective."

— Michael T., Software Developer

"I'm a visual learner and traditional financial books put me to sleep. These illustrations made complex concepts actually stick. I finally understand my money."

— Jessica R., Teacher

"Went from feeling completely overwhelmed by finances to having a clear plan. The illustrated format made it feel approachable instead of intimidating."

— David L., Recent Graduate

"This guide gave me the foundation to ask the right questions about insurance, investing, and planning. I finally feel equipped to make smart money decisions."

— Amanda K., Nurse

"Laura gets it. She understands our economic reality instead of lecturing us about systems that no longer exist. This advice actually works for our generation."

— Carlos R., Accountant

Frequently Asked Questions

What exactly is The Gen-Z Money Guide and how is it different?

It's a fully illustrated guide to personal finance designed specifically for young professionals facing today's economic challenges. Unlike traditional financial books, it acknowledges the reality of student debt, current housing costs, and wage stagnation while providing practical strategies that work within this system.

Do I need any financial background to understand this?

Nope. The illustrated format makes complex concepts accessible to complete beginners. If you can read and follow visual explanations, you'll be fine.

How long does it take to read through the guide?

Most people read through it in 2-3 hours. But you'll reference it repeatedly as you implement the strategies and make financial decisions.

What if I try it and it doesn't help me?

You're covered by our 30-day guarantee. If it doesn't help you feel more confident about money, just email and get a full refund. No hassle. You can even keep the guide.

How does this help with the overwhelm of conflicting financial advice?

Because it's designed as a complete system that shows how all areas of personal finance connect, rather than random tips from different sources.

You'll understand the "why" behind financial decisions, not just follow someone else's rules.

What makes this different from other financial books?

Three things:

1) The beautiful illustrations make complex concepts clear and memorable 2) It's written specifically for today's economic reality, not outdated assumptions

3) It acknowledges systemic challenges while empowering you to succeed within them.

Will this help me make better decisions in real situations?

Yes — that's one of its core strengths. You'll understand the principles behind financial decisions, so you can apply them to your unique situation rather than following rigid rules that might not fit.

Is this a one-time payment?

Yes, this is a one-time investment for a download of the guide.

GET THE Gen-Z MONEY GUIDE NOW!

30 Day Money Back Guarantee

Only $5.00 Today

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

This product is brought to you by Financial Lab, Inc. | Terms & Conditions | Privacy Policy